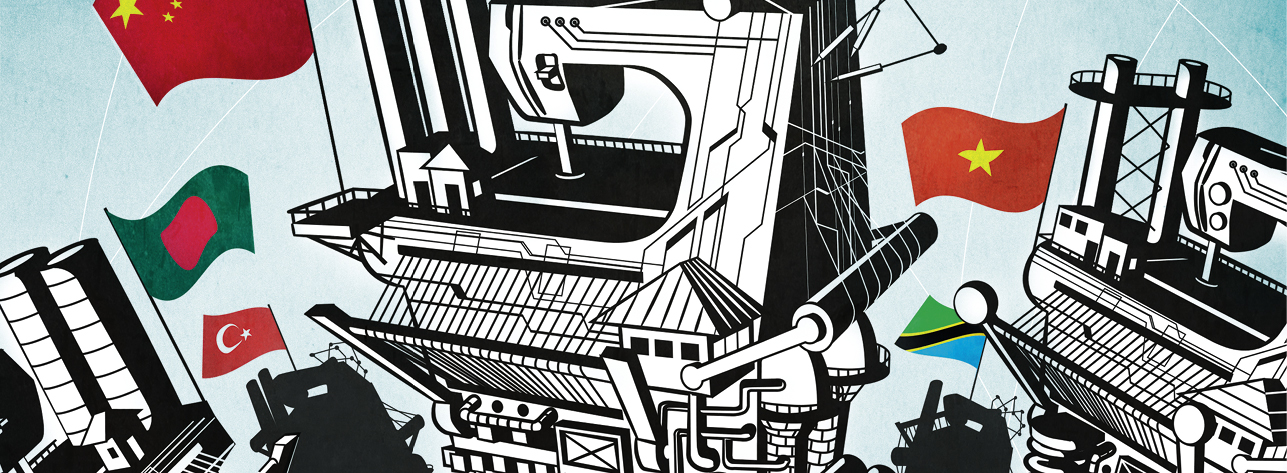

Things are starting to happen on the import markets: China is no longer the only “workshop of the world” and doesn’t want to be anymore either. This is posing the importers with challenges, but does at the same time bring with it opportunities – especially for new production locations.

It was about four years ago that the outgoing US President Barack Obama invited the late Steve Jobs to dinner. In reply to the question what it would cost to bring the iPhone production back to the USA, the founder of Apple answered quite clearly: “Those jobs aren’t coming back.” A sentence that still applies, even if Obama’s elected successor Donald Trump loudmouthedly promised “to get Apple to start building their damn computers and things“ in the US during the election campaign. The reasons are as obvious and exemplary for many production branches in the globalised world economy and are by no means of a purely financial nature: China is in the meantime in an excellent position in terms of knowhow and infrastructure. The country has over 800 million workers – hundreds of thousands work for the diverse Apple suppliers alone – including both unskilled workers and well-trained specialists. And there are much too few of both in the USA.

“Enormous volumes can be produced more or less overnight – that is only possible in China,” reported Thorsten Kohler, Executive Director of the Hamburg-based import company, Carstensen. “In terms of flexibility, speed and costs, the country is virtually unbeatable for large-scale projects.” However, China no longer has a dominant position and the overall picture of the “workshop of the world”, is beginning to crumble. Rapidly rising labour costs – since 2004 the average annual income has increased by around 12% – have already hailed in the end of “cheap China“. The cost of living has rocketed in many parts of the country, in many places one can no longer find workers, who are prepared to work hard for low wages, especially since there are a number of better paid alternatives in the meantime – especially when one has a leaving qualification that the majority of young Chinese people not only strive for today, but actually achieve. “Alternatives to China are much more important than five years ago,” said Kohler. “The dollar is extremely expensive, the workers are becoming significantly more expensive as a result of the improved social standards in China and the transport costs will continue to rise.”

The enormous growth that the Chinese economy has achieved over the last two and a half decades has meanwhile reached its peak: In 2015, the gross domestic product increased by 6.9% – that is the weakest growth rate in 25 years. The International Monetary Fund forecasted further declines – 6.3% for the present year and 6% growth next year. Figures that lie in the framework set by the government in Peking, which after decades of boom with in some cases two-digit growth rates is realigning the exportweighted economic model more towards the domestic economy and wants to boost private consumption. Indeed the global exports from China have declined significantly: After a 15% decline in March 2015, the figures continued to drop in the following months.

Hightech labour instead of a sewing machine

Mantis World’s factory in Tanzania: the country offers a host of advantages.

In the course of these planned changes in direction, the structures in the production centres are changing radically. “Politically-steered, China is reducing the production of cheap products further and thus the related burden on the environment, concentrating instead on the development of the country into a demanding production location for innovative products,” stated Kohler. “To this end, further acquisitions will take place in many industries in the West, because there is a strategic plan behind them that the government in Peking simply has to pursue to keep astride of the competition from Japan and Korea for example. In my opinion there will be shifts towards Vietnam, Myanmar, Indonesia and later perhaps even North Korea.”

In the same way that the low wage countries of the older generation – i.e. Japan, Korea or Taiwan – relocated their production to China from the 1990s onwards, for their part Chinese companies are now looking for new locations. Lowbudget products with a low technical complication degree that require a lot of manual labour are affected. “China has developed the tendency to relocate the so-called sunset industries with a large share of manual labour from the suburbs to Western China or to other states,” explained Rolf Daiber, CEO of the German textile specialists Gustav Daiber. “China itself would like to focus on the lucrative branches of industry, the extraction and further processing of raw materials, generation of energy and machine construction as well as high-tech industries such as automobile construction or electronics.”

However, since China not only wants to sell its products, raw materials and energy to industry states in the West, but also where possible also to developing and emerging countries as well as in the region, the outsourcing of production capacities also serves to develop new sales markets, as Daiber explained: “By relocating many production sites to Bangladesh, Myanmar or Africa, China reinforces the local economies and thus builds up export markets mid-term for the countries’ own products and services such as the construction of power plants.”

Hence, at the same time new production centres are evolving that attract the attention of the global market – as alternatives or as a strategically favourable enhancement to China. “China is intentionally moving up in its levels of sophistication and as it does so inevitably prices go up too. So yes, it is losing some of its advantages for low prices and basic items but it is gaining advantages at the higher end. Overall therefore China is and will remain to be a key sourcing location, but for our industry there is a definite trend of sourcing outside of China and it will become increasingly important to source some items elsewhere,” commented Mike Oxley, CEO of the British promotional products agency, Lesmar. The company is the British member of the international trading alliance Ippag (International Partnership for Premiums and Gifts). Founded in 1965, numerous import pioneers were among the founding members of Ippag. After initially starting off in Taiwan or Hong Kong, the member companies of the group built up a far-reaching network in China over the decades, but they have also been focusing on other places for some time already. “Electronics are still very much in China, but for other products, Eastern Europe, Vietnam, Bangladesh, and Turkey are good alternatives – the latter three especially for textiles. We are also investigating Latin America and see developing potential.”

Boom country Bangladesh

In the textile sector, China has no longer been the undisputed leader for some time already, a significant production centre in Bangladesh has already been developing since the 1980s. In the course of the boom in the millennium decade, the small country became the second largest textile producer behind China, more than 80% of the exports from Bangladesh are readymade garments (RMG) today. As the consulting company McKinsey 2011 forecasts in the scope of a survey, Bangladesh will become the no. 1 in the RMG sector this year. According to the Bangladesh Garment Manufacturers and Exporters Association (BGMEA) there are currently 4,328 textile factories in Bangladesh, more than four mil. Bangladesh citizens work in the RMG sector – that is around 2.5% of the overall population. Furthermore, the textile industry in Bangladesh is in the meantime highly developed in terms of the infrastructure and equipment – that also applies for the working conditions in spite of many negative headlines: “Some textile factories in Bangladesh are ultra-modern even according to Western standards, have nurseries and schools for instance for the workers,” stated Daiber. “The workflow in particular is often impressive: The work steps for jackets for instance are so well-coordinated that the temporary storage of semi-finished goods becomes unnecessary.” Nevertheless: The factories in Bangladesh are operating at full capacity and it is difficult to develop new capacities in a country that is one of the most densely populated regions in the world. On top of this, after the catastrophes such as the collapse of the Rana Plaza building in the year 2013, the construction requirements for erecting new factories have been significantly stepped up.

And these are not the only reasons why many Chinese textile companies are outsourcing their production more and more frequently to alternative Southern Asian countries, as Daiber explained: “Large parts of the textile industry from China have relocated to Southern Asia, i.e. to Cambodia or Myanmar. Rain jackets, safety vests or basics are frequently already made there now, functional clothing or caps are however still at home in China.” Bangladesh is also only attractive to a limited extent for “smaller” importers and buyers, who specialise more in custom-made designs rather than on stock goods. “Bangladesh only comes into question as a production location for high volume orders, because the majority of producers are not interested in the small volumes that are usual for custom-made designs in the promotion and corporate wear sector,” explained Steven Baumgartner, CEO of cyber-Wear. “In addition to this there are still huge uncertainties as far as ethically responsible production conditions are concerned. We never took the path to Bangladesh, nor the ‘classic’ route to China. We only produce items that that we also sell on the Chinese market there, as well as highly-functional products for the sports and outdoor sector that our Turkish and Vietnamese partners aren’t able to manufacture.”

Quality wanted

Apart from high-tech clothing, the production of which China has a wealth of knowledge about, there are good reasons to have one’s textiles produced elsewhere, as Baumgartner underlined: “The understanding for quality was always idiosyncratic in China. It is extremely difficult to get good textile quality from China, especially if the production is completely in Chinese hands and no European partner is involved. Many Chinese manufacturers have had enough of the complicated demands of the Western customers and prefer to concentrate on the domestic market.“ So, for the majority of its projects in the textile sector, cyber-Wear relies on its locations in Turkey and Vietnam. “Both branches were originally production partners and today they are susbdidiaries of the Cybergroup, which we have shares in,” commented Baumgartner. In this way, the group that supplies renowned international customers with merchandising concepts, corporate wear and haptic advertising and which is one of the biggest promotional products agencies in Germany, secures a high and constant quality standard. “Textiles are a highly sensitive theme and the formula is quite simple: Quality has its price,” said Baumgartner. “Since quality was always important to us, we have been producing in Turkey since 1994. Alongside the quality standards, our location in Camdibi near Izmir offers many additional advantages, above all speed: Instead of spending five weeks at sea, the goods only take five to seven days by truck or if it is really urgent within 24 hours per air freight.”

cyber-Wear has also been operating a production location in Ho Chi Minh City since the year 2000. More than a third of all producing companies in the country are located in the region around the capital city of Vietnam. In total, according to the state foreign radio station, Voice of Vietnam, there are more than 2,000 textile fabrics and the textile exports have exploded over the past years. “Vietnam offers much higher quality than China,” said Baumgartner. “The sense of taste is also more similar to ours due to Vietnam’s history as a former French colony. Furthermore, there is a high level of education, communications are uncomplicated, because a lot of people speak English and one finds young, motivated employees – in contrast to China, where in the meantime many of the young generation prefer to work in the service sector.“

Whether in the Middle or Far East, Europe or Africa: There are a lot of alternatives to the “big players” in the textile sector. cyber-Wear for example buys its goods from Portugal, the Czech Republic and Poland. And in Africa textiles are not only made for the European market in Maghreb and in Egypt, but also in parts of the continent that hardly even showed up on the radar up until now: For instance, the British company Mantis World produces goods in its own factory in Tanzania and thus takes on a special role on the promotional market. However, for the CEO, Prama Bhardwaj, the location offers a host of advantages, which compensate for the challenges by far: “There is no shortage of raw materials in Tanzania, because cotton grows there, furthermore there is plenty of labour available. What’s more, the employee’s rights are much stricter in Tanzania than in many Asiatic countries. On the other hand, there are in some cases huge infrastructural problems – for example containers may get stuck at the docks for a month – and the Government isn’t doing enough about it. The ingredients are there to turn Tanzania into an attractive production location, but further development is required.“

Home advantage

Indian country pavilion at the Mega Show in Hong Kong: new production centres are attracting the attention of the global market.

However, there are not only a multitude of alternatives in the textile sector, but also for many other product groups. “We assert ourselves to find competent alternative European and also – where possible – North African suppliers,” noted Kohler. “This is becoming increasingly more often an alternative to China, where consistant product quality and true-to-specification products especially with chemically produced items can be a permanent challenge, particularly for children’s products that we always carry out strict tests on. In this way, in addition to selected products from South America, we buy among others products from Turkey, Tunisia, Bulgaria and Italy. Automated processes rarely cost more in Europe than in China, one is simply ‘closer’, which can be a big advantage for troubleshooting measures and for in comparison lower financing costs due to shorter terms.“

“The prices in China have gone up for many items and we find Eastern Europe and Turkey prices increasingly competitive especially for paper and some plastics,” added Oxley. “We also like the speed of service, lower minimum order quantities and flexibility out of Eastern Europe and Turkey versus other global markets.” Even EU countries with a high wage level are becoming interesting again, as Baumgartner reported: “We purchase leather and silk items from France and Italy, where there actually still are production sites for these product groups that are competitive and which offer a high level of quality. As a result of the crisis especially in Italy one is falling back on old competences and competitive advantages, in the meantime the country is gaining ground again also in the textile sector.“

The question how

Wherever the importers reach out their antennas – the same requirements for the product and the conditions under which it is produced apply. “The challenge is that many other developing markets are well behind China regarding CSR and that does make it that much harder to shift manufacturing given the CSR standards we require,” said Oxley. “Of course this doesn’t mean that China is ‘safe’. A lot has been achieved in China when it comes to working conditions, but there is still a long way to go especially with regards to electronics factories.“ Kohler added: “There is no doubt a backlog demand in other countries too when it comes down to CSR, however due to the sheer size of China it will take years to make sure the specifications are adhered to.”

“It is always depends on the owner of a factory – rather than the region where the factory is located as to whether there are social problems,” said Baumgartner. “Catastrophic circumstance can also prevail in Turkey. That is why it is essential to examine producers carefully before one cooperates with them.” One thing is certain: Companies that migrate from the classic Far East regions in the search of cheaper prices, will sooner or later end up with huge problems not only in terms of quality, but also in terms of ethic responsibility. “CSR and the demand for better and better, while at the same time cheaper and cheaper products is a huge contradiction in itself,” is how Kohler summed it up in a nutshell.

What stays in China

Yet, the outsourcing does have its limits. “Wherever one is considering to produce, first of all one has to build up a supplier base,” explained Baumgartner. “In comparison to China, this is only possible to a significantly more limited extent in many countries. No other country can compete with the mass of quickly available resources, know-how, infrastructure and manpower, that China disposes of – India for example only offers comparable conditions in its three large densely populated areas.” Because China has built up huge production centres for a number of product groups, which bundle a complicated network of experts, specialists, suppliers and manufacturers in one location and are unparalleled worldwide, the Chinese production initially remains without an alternative for certain product groups. These include for instance IT and electronic items: “In my opinion production will remain in China mid and longterm,” stated Jorg Herzog from the electronic specialists, Herzog Products. “The region around Shenzhen is at present the Chinese equivalent to the Silicon Valley for electronic consumer items. The international industry elite is focusing on this location and are permanently mutually stimulating each other. It is rather unlikely that this will change in the near future.”

So, neither smartphones, power banks, Bluetooth loudspeakers nor USB stick will be made in Central Europe or the USA in the future. Not even Donald Trump will be able to change that.

// Till Barth

photos: flickr.com/Travel Aficionado; ILO/Aaron Santos; Mantis World; Comasia; illustration: Jens C. Friedrich, © WA Media